Plug Power stock price has soared in the past few months, helped by a big energy deal and the recently passed Big Beautiful Bill. PLUG jumped to a high of $1.78 on Wednesday, its highest point since February, and 153% from its lowest point this year. Let’s explore why the stock has surged.

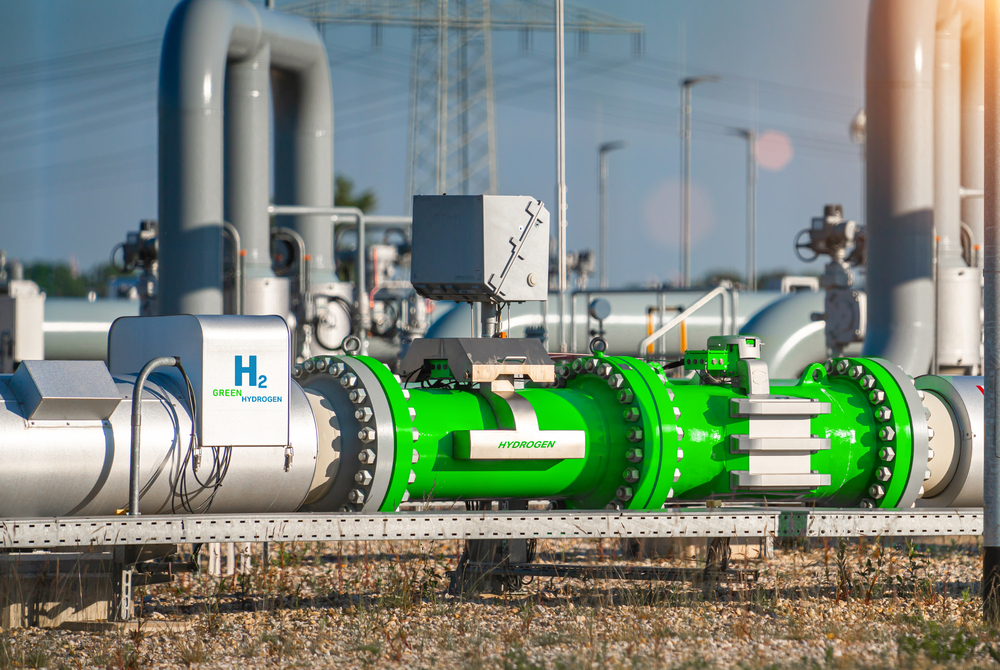

Plug Power hopes to dominate the hydrogen industry

Plug Power is a top American company valued at over $2 billion. It is the biggest firm focusing on hydrogen production, an industry that analysts expect to keep growing over time.

The company operates hydrogen production plants in places like Georgia, Tennessee, and Texas. Its Georgia plant produces 15 tons of hydrogen a day, while the Tennessee one makes about 10 tons a day. Its Beaumont, Texas plant produces about 50 tons of green hydrogen a day.

Plug Power also manufactures and sells electrolyzers. Some of its products are GenDrive, its hydrogen-fueled fuel cell system used by material handling EVs, and GenSyre, a stationary fuel cell solution that provides modular power to support power backup in several industries. Its other products are Progen, GenFuel, and GenCare, among others.

Plug Power stock price has crashed in the past few years as it has moved from one crisis to another. One of its main challenges is that some key areas of demand have not materialized.

For example, many utility companies continue to avoid hydrogen because of its higher cost compared to other energy sources. The hydrogen automobile industry has largely collapsed.

Plug Power has never turned a profit, has recently laid off workers, ha numerous delays, and has lost over $7 billion over the years.

Why PLUG stock price jumped

The Plug Power stock price has jumped after the company announced a new multi-year deal with an unnamed industrial gas company through 2030. The CEO said:

“As we continue to scale our applications business and build long-term partnerships with customers, reliable supply and cost efficiency are critical. This contract is a win for Plug, our customers, our suppliers and our margin profile.”

The company also announce that it expanded its collaboration with Allied Green, a company in Uzbekistan. It will help the company as it builds a new 2 gigawatt electrolyzer project. The entire project is worth over $5.5 billion.

The Plug Power stock price also jumped after the Big Beautiful Bill passed in Washington and got signed into law by Trump. In a statement, the company’s CEO said that it will be a top beneficiary because it extends two tax credits it and its customers use.

Most analysts expected the tax credits to end under Trump, as they were part of Joe Biden’s Inflation Reduction Act (IRA). As such, extending these tax credits is a big win for the company.

Meanwhile, analysts expect its annual revenue will be $733 million, up by 16% from 2024. It will then hit $1.02 billion in 2026. Additionally, the company’s earnings per share (EPS) are expected to improve from a loss of 61 cents to a loss of 3 cents next year.

Read more: Insiders are buying Plug Power stock: is a short-squeeze coming?

Plug Power stock price analysis

PLUG stock chart by TradingView

The daily chart shows that the PLUG share price bottomed at $0.6750 in May to a high of $1.7 today. It has jumped to its highest point since February 18.

The stock has moved above the crucial resistance level at $1.60, its lowest level in September last year. It has moved above the 50-day and 100-day moving averages.

Therefore, the stock will likely continue rising in the coming weeks, with the next point to watch being at $3.3, its highest point in June this year. This price is about 86% above the current level.

The post Here’s why the Plug Power stock price has surged appeared first on Invezz