Icahn Enterprises (IEP) stock price suffered a harsh reversal this week after the company suffered a major setback. It has crashed by over 15% this week, erasing some of the gains made earlier this month. It remains down by over 65% from its highest level in 2023.

CVR Energy woes

The IEP share price plunged hard this week after CVR Energy, one of its biggest holdings, announced weak results and suspended its dividend.

CVR made a net loss of over $124 million and an EBITDA loss of $35 million. Its loss per diluted share stood at $1.24.

These losses happened as the company continued spending more money on refining work. As a result, the management decided to suspend its dividend, leading to a sharp decline of its stock.

CVR Energy’s petroleum had a net loss of $110 million as its refining throughput dropped to 189,000 barrels per day.

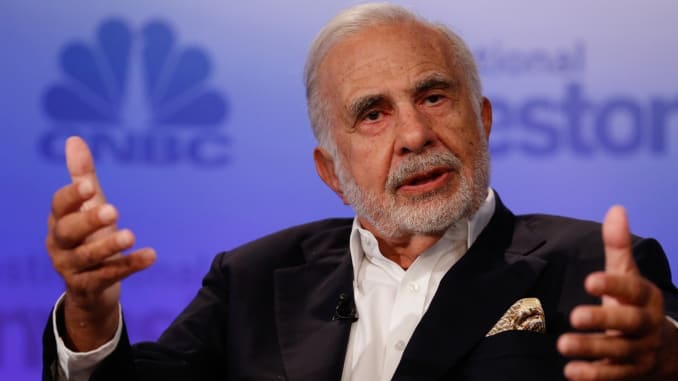

CVR is a major player in Carl Icahn’s business since it owns about 66% of the business. It is also a major source of his cash since it has paid dividends worth over $3.2 billion in the last decade.

CVR is not the only company in Carl Icahn’s business that is struggling. Bausch Health, formerly known as Valeant Pharmaceuticals, has crashed by over 77% from its highest level since 2020. It has barely moved in the past two years.

Similarly, Icahn Enterprises owns a big stake in Caesars Entertainment, a big player in the gambling industry. Caesars is not doing well as its stock has remained in a tight range in the past two years. It has plunged by over 66% from its highest level in 2022.

While the International Flavours & Fragrance (IFF) stock has rebounded this year, it remains sharply below its highest level in 2021. Other parts of Carl Icahn’s portfolio like Southwest Gas and Pep Boys are also struggling.

IEP is not doing well

Therefore, Carl Icahn’s portfolio will likely remain in the red for the foreseeable future. Besides, this is a firm that has generated negative returns in over a decade.

The most recent financial results showed that Icahn Enterprises business was not doing well. Its energy business had a net income of $347 million in the LTM to June 30.

Its food and packaging net income was just $4 million, while its real estate business made $11 million. Icahn’s pharma business made $5 million, while the home fashion had a net loss of $6 million. Altogether, its consolidated loss was $514 million.

A key issue in Carl Icahn’s portfolio is that it is made up of companies in industries that are no longer growing. For example, he owns no technology firms, which are expected to keep doing well in a low-interest rate environment.

Additionally, Carl Icahn will likely come under pressure because of his substantial debt load. He has already restructured some of his loans, including by pledging all his shares as collateral. Therefore, things could continue getting worse in the coming months as the company will likely slash its high dividend, whose yield stands at 31%

IEP stock analysis

IEP chart by TradingView

I have covered Icahn Enterprises several times in the past and recommended against the company. You can read my past converge here and here. On the weekly chart, it has remained below the 50-week and 100-week moving averages, meaning that bears are in control.

It has also remained below the key resistance level at $15.67, its lowest point in March 2020. Therefore, the path of the least resistance for the stock is bearish, with the next target to watch being at $9.82, the lowest point in September. 0720 832

The post IEP stock: No good reason to invest in Icahn Enterprises appeared first on Invezz